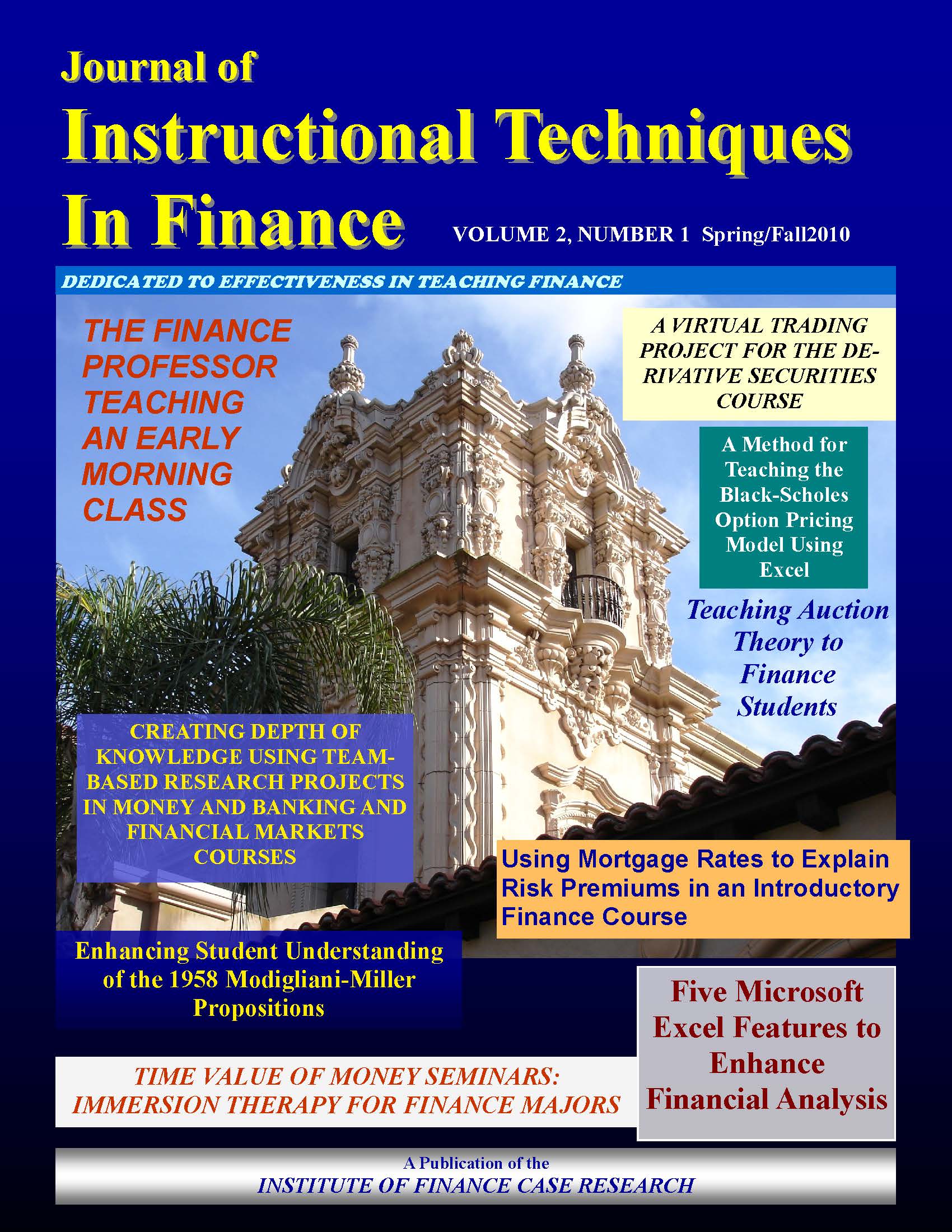

A Method for Teaching the Black-Scholes Option Pricing Model Using Excel

DOI:

https://doi.org/10.54155/jitf.v2i1.44Abstract

One of the most important concepts in modern finance practice

and education is option pricing. The Black-Scholes model of

option pricing is possibly the most commonly-used model. This

paper presents an implementation of the Black-Scholes model of

option pricing that includes graphs of the option value, the

intrinsic value, and the time value. These graphs are dynamic,

allowing the user to change the value of the volatility of

underlying asset returns, time to maturity, and the risk-free rate.

The user can also see how price of an option changes with

movements in the underlying asset price. By illustrating both

option prices and the components of option prices (intrinsic and

time value) over a range of underlying asset prices, students can

more easily visualize the effects of the drivers of option prices.